Bike insurance Prices starting at just ₹843/yr

Partnered with 32+ Leading Insurers.

Get the Add-ons.

Get the Add-ons.

Comprehensive Insurance goes beyond the basics. It covers third-party liabilities and protects your own Bike — against accidents, theft, fire, and natural disasters.With add-ons like Zero Depreciation, Roadside Assistance, and Engine Protect, you can customize your plan to match your drive.

Complete. Flexible. Powerful.

Third-Party Insurance covers damages to others — their vehicle, property, or injuries — caused by your Bike. It’s the most basic form of coverage, and it’s also mandatory by law.

It doesn’t cover your own bike’s damage, but it gives you the legal and financial shield you need against third-party liabilities.

Simple. Essential. Mandatory.

From accidents to theft, fire to floods

No Claim Bonus (NCB).

Safe driving pays off. With every claim-free year, you earn up to 50% discount It’s recognition for being responsible, and a powerful way to save while staying protected.

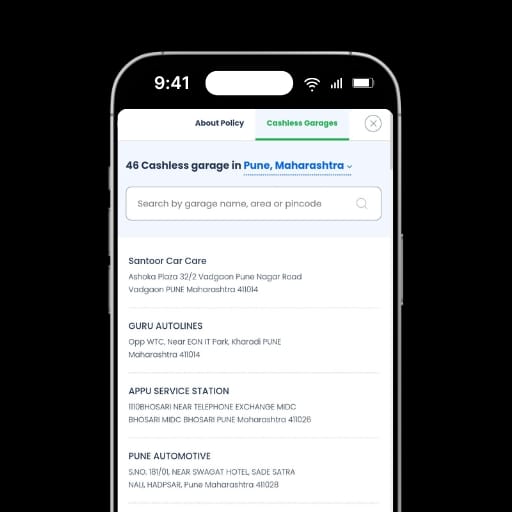

Cashless Garages.

Breakdowns and repairs don’t have to mean stress. With insurer’s wide network of cashless garages across the country, you can get your Bike repaired without paying upfront. The insurer settles directly with the garage.

From accidents to emergencies, our claim team is with you — 24/7. Fast responses, clear guidance, and smooth settlements mean you’re never left stranded. Every claim is handled with care and transparency, so you know exactly what to expect at every step. Whether it’s a minor repair or a major loss, Aero ensures your protection translates into action — quickly, clearly, and without the usual stress.

Things to keep in mind while buying a Two wheeler insurance policy

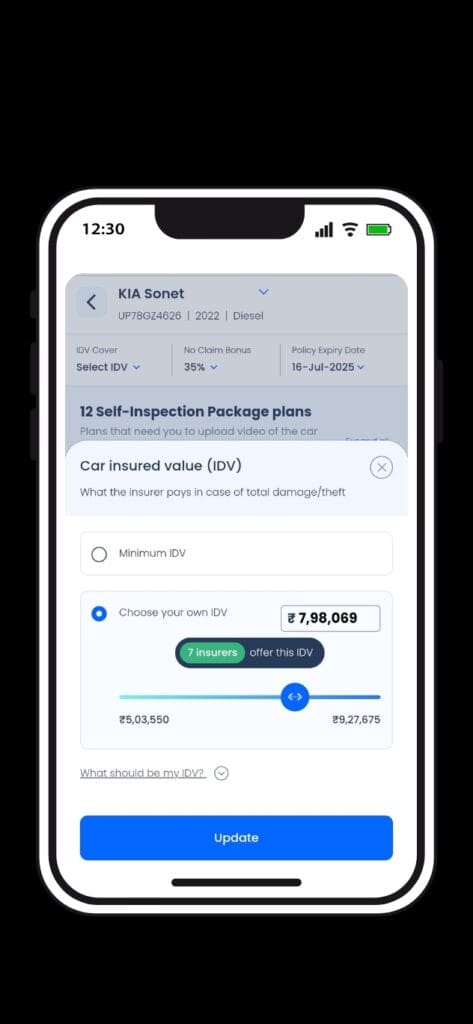

Right IDV (Insured Declared Value). Set your Bike’s value right. Too low, and you lose at claim time. Too high, and you overpay. you get it just right. Accurate. Fair. Trusted.

Coverage is king. Don’t just look at price. A cheaper policy with weak coverage can cost more at claim time. Always balance protection with premium.

Service matters more than savings. A policy is only as good as its claims support. Cashless garages and 24/7 help will matter more than a ₹500 discount.

Great powers come with

great privacy.

At Aero Insurance, your personal information is treated with the highest level of care. Your details, protected. Your name, mobile number, and email address are always safe with us. And if you don’t renew your insurance, your data is securely deleted within 90 days of expiry.

Government-issued documents like Aadhaar, PAN, and RC are stored with maximum SSL encryption, ensuring they remain private and protected at all times.

How do you get a Bike insurance quote?

Your Bike. Your cover. Your best price.

It’s simple. Fast. Hassle-free.

Book a free call.

Here – connect instantly with Aero.Talk to your Genius Advisor.

Our experts guide you through every step with clarity.Share a few details.

RC, previous insurance, claim history, or transfer info. that’s all we need.Discover add-ons.

Zero Dep, RSA, Engine Protect. know your options, choose wisely.Get your best quote.

Customize to your Bike. Transparent. No hidden surprises.

Comprehensive cover.

Protection in every dimension.

From third-party liability to own damage, from natural disasters to theft comprehensive Bike insurance is designed to cover every angle. Add-ons like Zero Depreciation, Engine Protect, and Roadside Assistance take protection even further. It’s more than a policy. It’s peace of mind, built for every journey.

Why People Trust Aero

Aarav Mehta

Got my bike insurance in just 10 minutes no paperwork, no waiting. Highly recommend them to every rider

Priya Sharma

I had an accident and my claim of ₹1.6 lakhs was settled in just one week! I didn’t have to run around or make endless calls. Aero Insurance handled everything for me

Jamalludin

Hiring has never been easier! The app connects us with top talent quickly and efficiently. A must-have for recruiters.

Neha Kapoor

I was confused about which policy to choose. The Aero team explained everything patiently and got me the perfect coverage at a great price. Felt truly cared for

Karan Singh

Renewed my TP policy online in under 15 minutes faster than ordering food! Hassle-free process and transparent pricing. Aero is my go to insurance partner now

Anil Kumar

When my scooter got damaged, I thought the claim process would take weeks. Aero surprised me claim approved in 3 days, money in my account on the 5th day

Trusted by 12,000+ insured

Frequently Asked Questions

We’re always here for you. email us at support@aeroinsurance.in. Our team is just a message away.

Aero Insurance is your trusted vehicle insurance advisor, helping you protect bikes, cars, and commercial vehicles with the right coverage at the right price.

Because we make insurance feel seamless. From instant quotes to lightning-fast claims, every step is designed to be clear, elegant, and stress-free.

Yes. With Aero, claims are smooth, transparent, and remarkably fast. Many of our customers have received settlements within 3–7 days no endless calls, no hidden hurdles.

Yes, our advisory and support are 100% free. You only pay the actual premium for your chosen policy.

Your new insurance awaits. Make it yours

We have a IRDAI Certified well-trained advisors who will walk you through any queries you may have and we'll even help you make a purchase. All you have to do is book a call.